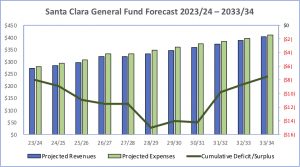

Santa Clara’s budget continues to bleed red ink. The City faces deficits between $8 million and $15 million over the next ten years, an annual average of $11 million. Rather than one-time shortfalls, Santa Clara has a chronic mismatch — structural deficit — between general fund revenue where expenses are growing roughly 2 to 4 percent faster than revenues over the next 10 years.

Labor costs are the largest share of general fund expenditures and overall these are projected to increase 43% over ten years. Retirement contributions are expected to grow 50% between now and 2034. This includes pension contributions for current employees as well as paying down the gap between what the City has paid into the state pension fund (CalPERS) and anticipated future payments to retirees (unfunded liability).

The 10-year forecast doesn’t include profits from non-NFL events at Levi’s Stadium. These historically delivered $2 to $5 million annually to Santa Clara’s bottom line before council imposed a no-waiver weekday policy in 2019. In 2021, the council restored the original policy of allowing about five curfew waivers a year, and there has been a significant uptick in highly profitable stadium events.

However, stadium profits aren’t enough to close the gap, so the City will have to bank on new development to boost property taxes. The Related project on Tasman Drive has yet to deliver any of the sales tax revenue that was promised when the developer got an exclusive negotiating agreement ten years ago and hidden subsidies in the form of rent deductions and caps.

Retirement costs have grown over the last 25 years for several reasons. One is CalPERS lost money in the stock market, especially during the dot-com bust of the early 2000s. Another is that CalPERS reduced the time agencies had to cover the unfunded liability. And a third is that in 2000, when Santa Clara’s pension account had a surplus (was super-funded), the City used the excess money for a pension contribution holiday.

Santa Clara’s budget has seesawed between deficits and surpluses since 2000. Although the dot-com bust and the crash after September 11 were blamed, then-City Manager Jennifer Sparacino told the council in 2005 that the deficits weren’t caused by the economy. Sparacino said they wouldn’t be remedied without structural — rather than one-time — changes to reduce expenses or increase revenue.

Neighboring cities don’t face Santa Clara’s budget problems.

Sunnyvale put $24 million into its reserves last year. Sunnyvale also forecasts revenue shortfalls over the next 10 years, but because Sunnyvale has $107 million in budget stabilization reserves, it will not face budget and service cuts.

Mountain View had a $6.8 million surplus last year and forecasts surpluses over the next 10 years.

Any change under the sofa cushions? When’s that Related option expire next? Time to make some money off what is city property after all. Were we even paid a fresh option price? My memory is “no”.