Super Bowl Impact – Hotel Tax Revenue Up

Hotel (TOT) tax collections are running well ahead of budget for FY2015-16, according to the March 22 Council meeting agenda report. Santa Clara hotels saw increased weekend occupancy compared to the same weekend in 2015, according to information from Smith Travel Research.

Occupancy rates rose 14 percent; from 70 percent to 84 percent. The estimated hotel tax collection for Super Bowl week is $292,000 above the same week in 2015 – with about $272,000 of that over Super Bowl weekend alone.

The information is buried in the list of Council budget priorities. Search on ‘TOT collections.”

2016-2017 Budget Items

In January the Council adopted a set of budget principles avowing that; among other things:

- Budget decisions will also consider how appropriations are perceived

- Projects and services should benefit the whole community

- Revenues should cover full cost of staffing and service additions

- Compensation for existing employees and funding for new positions should be balanced

- Vacant positions should be reviewed to determine whether they’re the optimal use of City resources

- One-time revenues should be restricted to one-time uses

- Postponed maintenance and improvements should be a priority

- Fees should be based on full cost recovery when specific individuals or businesses benefit from services

In February and March, the City Council had study sessions on the 2016-2017 budget, producing a laundry list of un-prioritized items; some of whose relationship to January budget principles was sometimes hard to see.

There are specific directives like maintaining streets at a higher quality rating level than they are presently. There are blue-sky suggestions with little bearing on producing a final budget in the next 60 days, like “consider alternate open space ideas.” There are items like “continue to build reserves” that are principles, not a goals. There is the addition of a number of high-level administrative positions, including a Stadium Authority contracts administrator and accountant. And there are requests for operational reports that are (or should be) part of normal operations, and directives about how the FY2017 budget should be organized, and scheduling more budget meetings.

The full list can be found on SantaClaraCa.gov by visiting the “View Online Council Meetings” page, selecting the March 22, 2016 agenda, clicking on item 2.A., and selecting the agenda report on the lower right hand side of the screen. The next budget meeting is Apr. 19 to consider the city’s fee schedule. There will be five more budget review meetings: May 10, May 17, May 24, June 7, June 21. Go to santaclaraca.gov/government/departments/finance and select 2016-2017 Budget Study Sessions and Hearings for more information.

Both Sunnyvale and Mountain View have full-time budget departments that develop, monitor and analyze operating and capital budgets and long-term financial plans.

Mountain View has an interactive tool that provides a point-and-click graph of budgets and budget detail. Here’s an example of the granularity of detail. Mountain View has budgeted $9,500 for pension contributions for employees working on North of Bayshore planning activities this year. Find it at mountainview.opengov.com/transparency#.

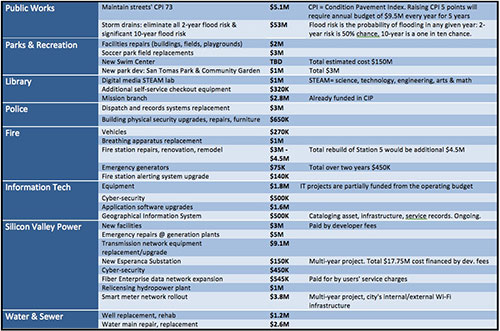

Infrastructure Proposals for 2016-2017: Making Up for Lost Time

Infrastructure was the subject of the second study session on March 22 – specifically, short-term capital improvement projects for 2016-2017. Many capital projects have been delayed over recent years because there wasn’t money available, and the $108 million worth of proposals reflect that.

Money for capital improvements comes from three sources.

Streets and Highways Funds: Money earmarked for street and roadway improvements comes from state gasoline taxes and vehicle registration fees, as well as county and state transportation grants.

Enterprise Funds:Capital projects for Santa Clara’s electric, water, sewer, solid waste, and cemetery utilities are funded by the revenues of those utilities.

Authority Funds: Income from Santa Clara’s joint powers agencies: Sports and Open Space Authority, Housing Authority, Stadium Authority.

General Government Funds: Money from Santa Clara’s general fund capital reserves, federal funding and grants.

The accompanying chart shows the proposed major projects in each area.

0 comments