About a year ago, California Governor Jerry Brown proposed changes to California’s 80 year-old public employee pension plan. One provision of that proposal is investment-risk sharing.

The U.S.’s largest pension fund, CalPERS manages retirement benefits for about 1.5 million California employees and retirees.

The current defined benefit pensions mean that employers – ultimately the taxpayers – bear the entire risk for investment losses. That’s compared to private sector IRA and 401(k) plans – defined contribution plans – where the employee takes all the investment risk. Brown proposes a plan that increases employee contributions and reduces – but doesn’t eliminate – the guaranteed benefit.

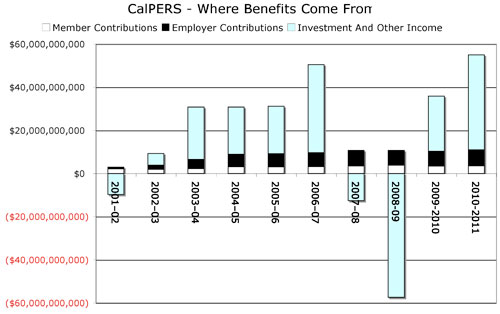

The reason this is important is that currently CalPERS funds retirement benefits largely with return on its nearly $240 billion investment fund. Employer and employee contributions account for less than a quarter of CalPERS’ income.

“Even with the bad years, most of the money put into the plans comes not from employee and employer contributions, but rather from investment return,” explains Santa Clara Director of Finance Gary Ameling. And currently, employee contributions (as a percent of salary) stay constant regardless of fund performance.

One might think that kind of exposure to risk would make CalPERS managers cautious. They may be now, after the economic collapse began in 2000. But 12 years ago, CalPERS apparently assumed the booming dot-com – private sector – economy would return a free lunch for public pensions.

In 2000, CalPERS was “super-funded,” at 118 percent of its liabilities. So the fund kept contribution rates artificially low with “payment holidays” during 2001-02 and 2001-03, explains Ameling.

Since then, CalPERS has changed the rules and payment holidays are things of the past. But the impact of those losses will be felt for many years to come.

For more information about CalPERS, visit www.calpers.ca.gov. For the details of Governor Brown’s pension reform plan, go to gov.ca.gov/docs/Twelve_Point_Pension_Reform_10.27.11.pdf.